| Capital at risk. All investments involve risk and investors may not get back the amount originally invested. |

Insight

In his recent analysis, SMDAM's Chief Global Strategist Hisashi Shiraki, examines the rise in Japanese long-term interest rates and its potential influence on future monetary policies:

“Market participants usually focus on the 10-year government bond as a benchmark. However, it is crucial to note that looking solely at the 10-year bond might be misleading regarding the direction and magnitude of changes in the Japanese bond market.

The Bank of Japan decided to keep its policy rate unchanged at its policy meeting on 19th December 2024, and Governor Ueda made cautious remarks about implementing additional rate hikes, thereby disappointing market expectations. Despite these decisions and comments from the BOJ, Japanese long-term interest rates have risen again, and the 10-year bond yield has reached its highest level in 13 years.

Why did this contradictory reaction occur? The answer lies in the reaction of the foreign exchange market after the BOJ’s decision, where the yen has depreciated significantly—by as much as five yen against the US dollar just after the dovish comments by Governor Ueda. Excessive currency depreciation raises import prices, which in turn pushes up consumer prices, eventually compelling the BOJ to tighten monetary policy further.

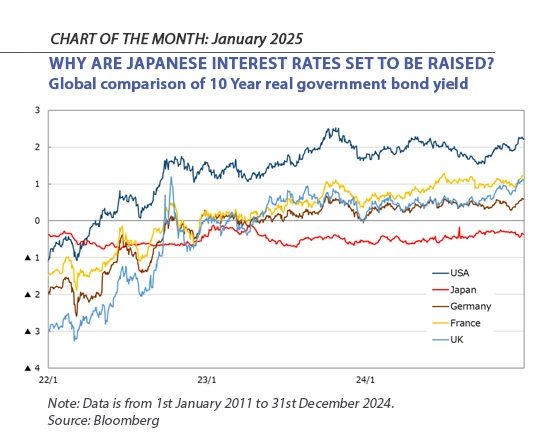

Japan’s Consumer Price Index was up 2.9% year-on-year in November, at a similar level to its global peers, including the US, the UK, and other European countries. Meanwhile, Japan’s policy interest rate remains extremely low at 0.25%, resulting in an ultra-loose monetary policy. Consequently, as shown in the image, Japan’s real interest rates remain extremely low compared to other G7 countries. As Japan’s real interest rate is the only one among major countries that is negative amid ongoing inflation, it is becoming increasingly challenging for the BOJ to maintain such an extremely low interest rate.

As mentioned at the beginning, the 10-year government bond yield of Japan likely remains lower than fundamentals would suggest due to the aftermath of extreme quantitative easing. If we look at the yield of the 5-year government bond, which is less influenced by such policy bias, it is rising more clearly and robustly than the 10-year JGB, having already reached its highest level in 15 and a half years.

Given this context, it appears that Japan’s interest rates will continue to rise in tandem with additional monetary tightening by the BOJ. If the BOJ hesitates to implement further rate hikes in the near future, it is highly possible that it will be forced into more rapid rate hikes in order to deal with rising import prices triggered by yen depreciation. If it’s a matter of time before rate hikes are inevitable, it is preferable to raise rates before further yen depreciation occurs, which would cause less damage to the market and the economy."

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Richard HAXE

Managing Director, Head of Business Development

Alex BARRY

Executive Director, Head of Distribution - UK and Ireland

Chloé CHOQUIN

Director, Business Development & Client Relations

Thomas CARTWRIGHT

Director, Business Development & Client Relations

|

General disclosure: The material is intended for professional and institutional investors only. This material is intended for information purposes only without regard to any particular user's investment objectives or financial situation and should not be construed as an offer, solicitation, recommendation, or advice to buy or sell securities or pursue any investment strategy in any jurisdiction. Any examples used, charts, and graphs are generic, hypothetical, and for illustration purposes only. Any forecasts, figures, opinions, or investment techniques and strategies contained are for information purposes only, and are based on certain assumptions and current market conditions that are subject to change without prior notice. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. Nothing in this material constitutes accounting, legal, regulatory, tax or other advice. No representation or warranty is made as to the accuracy, completeness, fairness or timeliness of the statements or any information contained herein. This material is not legally binding and no party shall have any right of action against Sumitomo Mitsui DS Asset Management (UK) Limited, including our affiliates, in relation to the accuracy or completeness of the information contained in it or any other written or oral information made available in connection with it. The views expressed are those of the author at the time of the writing. The material is correct to the best of our knowledge at the date of issue and subject to change without notice. The intellectual property and all rights of the benchmarks/indices belong to the publisher and the authorised entities and individuals. All right, title, and interest in this material and any information contained herein are the exclusive property of Sumitomo Mitsui DS Asset Management (UK) Limited, except as otherwise stated. This material is issued by Sumitomo Mitsui DS Asset Management (UK) Limited. Registered in England and Wales. Registered office: 100 Liverpool Street, London, EC2M 2AT, United Kingdom; registered number 01660184. Authorised and regulated by the Financial Conduct Authority. This material and the information contained may not be copied, redistributed, or reproduced in whole or in part without the prior written approval of Sumitomo Mitsui DS Asset Management (UK) Limited. Risk warning: Investment involves risk, including possible loss of the principal amount invested, and the value of your investment may rise or fall. Past performance is not a reliable indicator of future performance and may not be repeated. An investment’s value and the income deriving from it may fall, as well as rise, due to market fluctuations. Investors may not get back the amount originally invested. |