| Capital at risk. All investments involve risk and investors may not get back the amount originally invested. |

Insight

Last month we highlighted market reaction to the Bank of Japan’s decision in December to keep its main policy rate unchanged. This month we focus on:

- The labour market dynamics feeding into rates and FX expectations;

- Signs the BoJ might now be willing to steer a less cautious path;

- And is deflation finally in the rearview mirror for Japan?

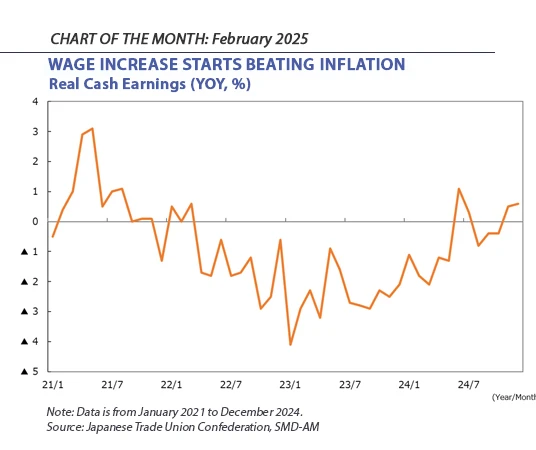

The chart illustrates a process of fundamental change in the Japanese economy. Change in real earnings for Japanese workers has been trending upwards since 2023 and finally overtook inflation in Q3 2024. Not only is the increased consumer spending power expected to impact interest rates and the dollar/yen rate, but it could prove to be a leading indicator for the Japanese economy as a whole.

As I have repeatedly argued, there is still significant room for interest rates to rise in Japan. This is because consumer price inflation has been at or over 2% for several years now. Meanwhile, the BoJ has held back from tightening monetary conditions.

As a result of this discord between inflationary pressure and embedded loose monetary policy, Japan's 10-year real yield now stands at -0.3%, the only negative rate among the G7 countries, and significantly lower compared to that of the US at +2%. This divergence is one of the main contributors to the extreme depreciation of the yen versus the US dollar. This in turn generates further upward pressure on the price level in Japan, where 90% of energy and 60% of food are imported. This process of ‘importing inflation’ has left Japan caught in a negative spiral whereby low real interest rates → yen depreciation → high inflation → low real interest rates, and breaking out of this cycle requires decisive action to raise nominal and real interest rates by the BoJ.

However, SMDAM’s Japanese macroeconomic research platform is increasingly detecting signs that this negative spiral is approaching an inflection point. With policy decision-makers now gaining confidence that they have a wider range of parameters in which to maneuver whilst avoiding deflation, the positive trend in real wages shown above indicates that the economy could be entering an expansionary phase.

On February 4th, BoJ Governor Ueda explicitly stated that "Japan is currently experiencing inflation," marking a clear shift from the previous narrative focused on justifying further monetary easing. Additionally, on February 6th, BoJ Policy Board Member Tamura stated that "Japan's neutral interest rate is at least 1%."

Following these unprecedented remarks from high-ranking central bank officials, the 10-year JGB yield has risen to the 1.3% level for the first time in 14 years, and there are emerging upward pressures on the yen. Indeed, we can be reminiscent of Trump’s comment in April last year that the US Dollar’s 34-year high versus the Yen was a “disaster” for US manufacturers. With Trump now in power, the Yen’s depreciation versus the Dollar could be set to reverse.

Expect to see more output from us on this over the course of 2025.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Richard HAXE

Managing Director, Head of Business Development

Alex BARRY

Executive Director, Head of Distribution - UK and Ireland

Chloé CHOQUIN

Director, Business Development & Client Relations

Thomas CARTWRIGHT

Director, Business Development & Client Relations

|

Disclaimer An investment’s value and the income deriving from it may fall, as well as rise, due to market and currency fluctuations. Investors may not get back the amount originally invested. The information on this website is not intended to be investment advice, tax, financial or any other type of advice, and is for general information purposes only without regard to any particular user's investment objectives or financial situation. The information is educational only and should not be construed as an offer, solicitation, or recommendation to buy, sell, or transact in any security including, but not limited to, shares in any fund, or pursue any particular investment strategy. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, and are based on certain assumptions and current market conditions that are subject to change without prior notice. The views of Sumitomo Mitsui DS Asset Management (UK) Limited reflected may change without notice. In addition, Sumitomo Mitsui DS Asset Management (UK) Limited may issue information or other reports that are inconsistent with, and reach different conclusions from, the information presented in this report and is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report. Decisions to invest in any fund are deemed to be made solely on the basis of the information contained in the prospectus and the PRIIPS KID accompanied by the latest available annual and semi-annual report. |