Outlook on the Japanese equity market

The MSCI Japan index declined due to an appreciation of the yen against the US dollar, although US stocks surged as Trump’s victory was assured early. Specifically, Japanese stocks were weighed down, partly by market speculation that the Bank of Japan would raise interest rates in December, which narrowed the interest rate gap between Japan and the US, leading to a further appreciation of the yen against the US dollar.

Following Trump’s victory in the US presidential election, the Japanese stock market saw an immediate rise. However, gains subsequently narrowed gradually over time, driven by market caution in light of the nomination of anti-vaccine activist Robert F. Kennedy Jr. as Secretary of the Department of Health and Human Services (HHS) in the incoming Trump administration, as well as Trump’s remarks about tariffs on imports from Mexico and Canada, amongst other factors. Shares of NVIDIA, which has led the AI-driven names, fell slightly after the release of its financial results, which weighed on Japanese semiconductor stocks, even though the chip giant’s revenue, earnings per share (EPS) and earnings guidance beat analysts’ consensus estimates

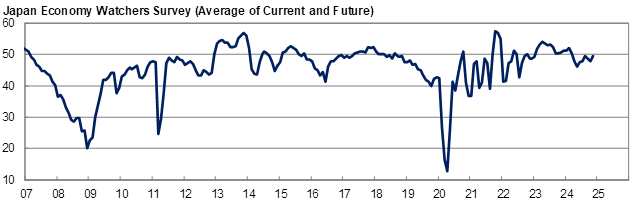

Economy: leading indicators improved slightly

Timely leading economic indicators improved slightly in November, making us somewhat more optimistic about the Japanese economy than before. Looking at the average of current and future economic conditions of the Economy Watchers Survey, the November data showed an improvement from the previous month. Comments from those surveyed suggest the following three reasons for the improved reading:

1) Although sales of clothing and seasonal goods were somewhat sluggish in October due to the lingering heat of summer, the weather became cooler and season-related consumer spending was strong in November;

2) semiconductor and part of machinery-related business conditions somewhat recovered, and;

3) there were media reports that the Japanese government was planning

to reinstate subsidies for electricity and gas bills in January-March, 2025, which led to a more optimistic view from some consumer-related companies.

Negative impressions that I had on the Japanese economy from

the comments include:

1) Inflation is still weighing on the Japanese economy;

2) Companies in unpopular or low-wage industries seem to need a significant increase in personnel costs in the medium to long term;

3) The last policy rate hike is starting to have a negative impact on housing sales and capital investment

Economy: The number of Japanese companies that will go private after an activist investor acquires their shares could increase in the future -- positive for Japanese equities

We have the impression that activist investors have been increasingly active in relation to Japanese equities. In the past, the typical sequence of events for an activist investor was as follows:

1. The activist investor acquires shares in a company.

2. The activist investor proposes that the company implement measures to enhance its corporate value.

3. The company enhances its corporate value by adopting a more robust capital policy and other strategies.

4. The activist investor demands that the company repurchase the shares that the activist investor owns.

5. The company repurchases the shares.

However, we feel that an increasing number of news items appear to show the following sequence of events:

1. The activist investor acquires shares in a company.

2. The activist investor proposes that the company implement measures to enhance its corporate value.

3. The company enhances its corporate value by adopting a more robust capital policy and other strategies.

4. The company is taken private by a private equity (PE) firm or a competitor of the issuer.

Activists are both good and bad for us, but we used to think that the biggest problem in the activist business is greenmailing, because if the company bought back the shares held by an activist investor at a high price, it would be detrimental to the corporate value for the other shareholders. However, if a PE firm or a competitor were to acquire all shares in the company, the other shareholders would benefit from the acquisition as long as the acquisition price is reasonable, so we believe this

development is positive for Japanese stocks.

Specifically, Seven & i, whose shares are partly owned by activist investor ValueAct Capital, appears to have received acquisition proposals from a competitor, etc. More recently, Topcon, whose shares are also held by ValueAct, also appears to have received buyout proposals from PE firms. If this type of deal were to increase, the share prices of undervalued companies could soar as a result of going private. In addition, the management of such companies may become more serious about increasing their corporate value in order to avoid being taken over. Such a move is positive for Japanese equities.

The following is an outline of Topcon news:

An outline of a speculative media report on Topcon going private

According to multiple sources, Topcon conducted its first round of bidding in September to privatize the eye-care equipment maker, narrowing the offers to KKR and EQT. Although Japan Investment Corporation did not participate in the bidding, it has since come forward, and the three companies are expected to proceed to the second round of bidding. The sources said that the second round of bidding will take place this month, with further adjustments being made. Topcon’s largest shareholder is US activist fund ValueAct, which owns 13.69%, according to Bloomberg data.

ValueAct is said to have been calling for the company to sell some business segments or go private, arguing that there is no synergy between the businesses, citing a conglomerate discount. The investment fund selected from the three companies will acquire all shares through a takeover bid (TOB), and Topcon will be delisted. There is also a possibility of an MBO (management buyout), in which the Topcon management team, including President Takashi Eto, will participate.

An opinion from our analyst in charge

In December 2024, Bloomberg reported that the company was “in the bidding process to go private”. The stock price subsequently hit a limit high. Topcon subsequently made a timely disclosure, commenting that “we are considering a wide range of measures, not just the one reported by the media (going private).” ValueAct has owned more than 13% of the company’s shares since May 2023, and Topcon’s IR department and management team commented that they were receiving useful advice from ValueAct on cost reductions and other measures to improve corporate value.

Topcon has actually been cutting costs, mainly in its positioning business, at a speed that is unbelievably faster than in the past, and our analyst watching Topcon appreciated this point. Therefore, the analyst assumed that the company would work with ValueAct to reduce costs in preparation for the next cycle of construction and agricultural machinery, so this privatization is surprising. However, if this privatization is true, the focus of attention will be on the TOB price and whether or not there will be any further bidding participants.

The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

Investment strategy

We expect that the Japanese equity market to advance in the short and mid-term because corporate Japan is cash rich and we expect them to use their cash effectively to accelerate EPS growth and further increase shareholder returns. The Tokyo Stock Exchange’s call for listed companies to increase their P/B (price-to-book-value) ratios, and the new NISA (Nippon Individual Savings Account) program should also provide a boost to the market. Policies that are more open to foreign capital, including an improvement in corporate governance, as well as policies to boost the immigration intake, are likely to support the market. We identify external factors, such as the outbreak of financial crisis and global recession, as major risks. Taking these into consideration, we will overweight low-P/B companies with large net-cash positions or a lot of unrealised gains on land.

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Richard HAXE

Managing Director, Head of Business Development

Alex BARRY

Executive Director, Head of Distribution - UK and Ireland

Chloé CHOQUIN

Director, Business Development & Client Relations

Thomas CARTWRIGHT

Director, Business Development & Client Relations

|

General disclosure: The material is intended for professional and institutional investors only. This material is intended for information purposes only without regard to any particular user's investment objectives or financial situation and should not be construed as an offer, solicitation, recommendation, or advice to buy or sell securities or pursue any investment strategy in any jurisdiction. Any examples used, charts, and graphs are generic, hypothetical, and for illustration purposes only. Any forecasts, figures, opinions, or investment techniques and strategies contained are for information purposes only, and are based on certain assumptions and current market conditions that are subject to change without prior notice. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. Nothing in this material constitutes accounting, legal, regulatory, tax or other advice. No representation or warranty is made as to the accuracy, completeness, fairness or timeliness of the statements or any information contained herein. This material is not legally binding and no party shall have any right of action against Sumitomo Mitsui DS Asset Management (UK) Limited, including our affiliates, in relation to the accuracy or completeness of the information contained in it or any other written or oral information made available in connection with it. The views expressed are those of the author at the time of the writing. The material is correct to the best of our knowledge at the date of issue and subject to change without notice. The intellectual property and all rights of the benchmarks/indices belong to the publisher and the authorised entities and individuals. All right, title, and interest in this material and any information contained herein are the exclusive property of Sumitomo Mitsui DS Asset Management (UK) Limited, except as otherwise stated. This material is issued by Sumitomo Mitsui DS Asset Management (UK) Limited. Registered in England and Wales. Registered office: 100 Liverpool Street, London, EC2M 2AT, United Kingdom; registered number 01660184. Authorised and regulated by the Financial Conduct Authority. This material and the information contained may not be copied, redistributed, or reproduced in whole or in part without the prior written approval of Sumitomo Mitsui DS Asset Management (UK) Limited. Risk warning: Investment involves risk, including possible loss of the principal amount invested, and the value of your investment may rise or fall. Past performance is not a reliable indicator of future performance and may not be repeated. An investment’s value and the income deriving from it may fall, as well as rise, due to market fluctuations. Investors may not get back the amount originally invested. |