| Capital at risk. All investments involve risk and investors may not get back the amount originally invested. |

Insight

In his recent analysis, SMDAM's Chief Global Strategist Hisashi Shiraki focuses on a typical myth about the Japanese economy and corporate earnings.

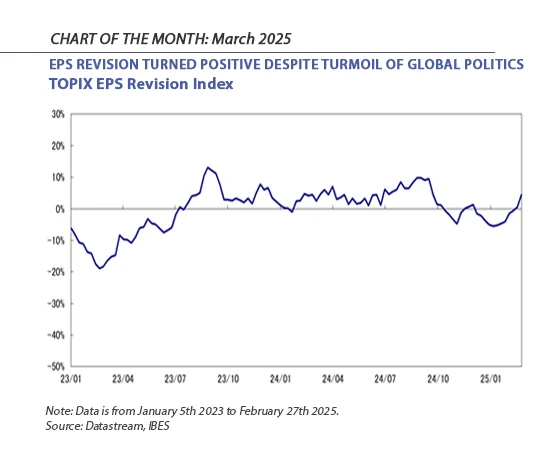

"Concerns over the US economy are intensifying due to President Trump's tariff policies and a series of weaker-than-expected economic figures for US consumer-related indicators. Surprisingly, however, the Japanese EPS revision index—an index that quantifies the direction of analysts' earnings forecast revisions—has been markedly improving, and has recently turned positive in Q1 2025 after a weak preceding Q4 as can be seen in March’s Chart of the Month.

In a global financial market that is increasingly wary of President Trump's actions, the positive trend in Japanese corporate earnings is not surprising to investors who have sufficient knowledge about Japan's economic fundamentals.

Currently, Japan is experiencing a virtuous cycle of “wage increases and price rises”, and market interest rates are on the rise. Increasing interest rates signifies a normalization of the business environment and is driving a rapid recovery in the performance of the financial sector, particularly for banks that earn service fees from the daily settlements related to the interest rate spread between liquid deposits and loans. Moreover, strong inbound consumption and the steadily rising trend in service prices are together driving a favorable earnings trend for non-manufacturing industries. Additionally, regarding the automobile industry which is one of the most important parts of Japanese economy, the impact of Toyota's production suspension due to certification fraud has now subsided, and production has returned to an improving trajectory. Considering these points, it is clear that Japanese corporate earnings are overall on a upwards trend.

From a macroeconomic perspective, it seems that the Japanese economy is largely unaffected by the commotion caused by Trump’s tariffs. This is because Japan's trade dependency ratio, the value of exports divided by GDP, remains at around 12%, significantly low when compared to around 40% for countries like Germany and other EU nations, and South Korea.

Moreover, since the Great East Japan Earthquake in March 2011, many nuclear power plants have been shut down, leading to a significant increase in fossil fuel imports, resulting in a substantial trade deficit for Japan. Therefore, the impact of Trump's tariffs on the Japanese economy seems likely to be marginal, contrary to the general perception.

While Japanese stocks are currently undergoing corrections amid a “global risk-off” atmosphere, if the appropriate understanding of Japan’s economy and corporate fundamentals outlined above becomes more widely known, it would not be surprising if market attention shifts towards the resilience of Japanese companies to the 'Trump crisis.' "

Invest with us

If you have any account or dealing enquiries, please contact BBH using the following contact details:

Brown Brothers Harriman (Luxembourg) S.C.A.

80, route d’Esch, L-1470 Luxembourg

T: +352 474 066 226

F: +352 474 066 401

E: Lux.BBH.Transfer.Agent@BBH.com

Richard HAXE

Managing Director, Head of Business Development

Alex BARRY

Executive Director, Head of Distribution - UK and Ireland

Chloé CHOQUIN

Director, Business Development & Client Relations

Thomas CARTWRIGHT

Director, Business Development & Client Relations

|

Disclaimer An investment’s value and the income deriving from it may fall, as well as rise, due to market and currency fluctuations. Investors may not get back the amount originally invested. The information on this website is not intended to be investment advice, tax, financial or any other type of advice, and is for general information purposes only without regard to any particular user's investment objectives or financial situation. The information is educational only and should not be construed as an offer, solicitation, or recommendation to buy, sell, or transact in any security including, but not limited to, shares in any fund, or pursue any particular investment strategy. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, and are based on certain assumptions and current market conditions that are subject to change without prior notice. The views of Sumitomo Mitsui DS Asset Management (UK) Limited reflected may change without notice. In addition, Sumitomo Mitsui DS Asset Management (UK) Limited may issue information or other reports that are inconsistent with, and reach different conclusions from, the information presented in this report and is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report. Decisions to invest in any fund are deemed to be made solely on the basis of the information contained in the prospectus and the PRIIPS KID accompanied by the latest available annual and semi-annual report. |